nassau county tax grievance status

Under New York State Law filing a Property Tax Grievance cannot raise your Nassau Property Taxes. Our record reductions in nassau county.

Understanding Your Nassau County Assessment Disclosure Notice

PAY MY BILL GET STARTED.

. All Live ARC Community Grievance Workshops. Its free to sign up and bid on jobs. Please Login to Continue The requested page cannot be accessed without logging in.

Nassau County Tax Lien Sale. However the property you entered is not located in Nassau County and we only file tax grievances for Nassau County properties. ARCs services for homeowners commercial taxpayers and tax.

For 2022 Have Now Been Completed. For specific grievance questions about your property we suggest you contact ARC Customer service at 516-571-3214 or by e-mail at arcnassaucountynygov. When Will My Assessment Reduction Appear on My Tax Bills.

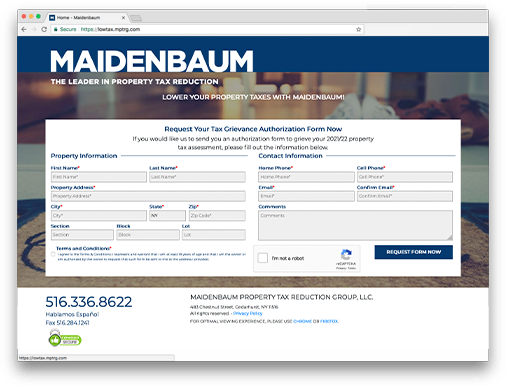

For the last 18 years he has. How it works. Click to request a tax grievance authorization form now.

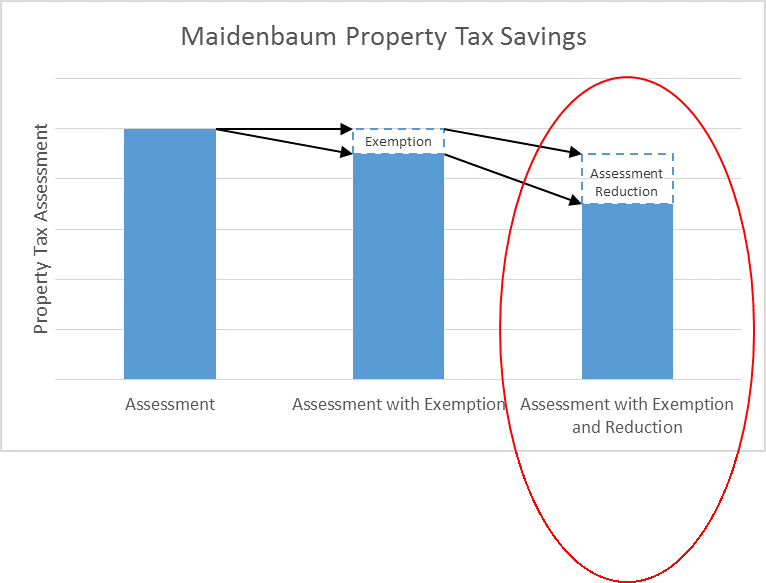

For the 20232024 tax year a successful assessment reduction may be reflected in 3 possible ways. Your assessment cannot be increased as a result of a grievance for that year. How to Challenge Your Assessment.

LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM. Appeal your property taxes. March 1 taxable status date all property is valued as of its condition on march 1.

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing Period to May 2 2022 The Assessment Review Commission - ARC - acts on appeals of county property assessments. Assessment Challenge Forms Instructions. Search for jobs related to Nassau county tax grievance status or hire on the worlds largest freelancing marketplace with 20m jobs.

Rules of Procedure PDF Information for Property Owners. Between January 3 2022 and March 1 2022 you may appeal online. FOR THE 20232024 Nassau COUNTY FILING.

There are only two possible results of filing a Nassau County Long Island tax grievance. The tax grievance process is a lengthy and complicated one. Nassau County residents should file a tax grievance each and every year.

We will keep you posted on the status of your tax grievance and any change in the status of your case andor settlement offer from the County in a timely manner. Tenants who are required to pay property taxes pursuant to a lease or written agreement. Nassau Countys assessment grievance system.

Your assessment will be reduced or it will remain the same. Given that multiple years tax challenges can be occurring at the same time Maidenbaum sends fully personalized summary letters explaining the status of each challenge. Click to request a tax grievance authorization form now.

If you file for yourself you may check your appeals status on-line at any time. At the request of Nassau County Executive Bruce A. Any homeowners in Nassau that misses the Property Tax Grievance deadline of March 1st 2022 must wait until 2023.

Is located on our home page. If youve chosen us to represent you feel free to email. At the request of Nassau County Executive Bruce A.

Any person who pays property taxes can grieve an assessment including. ARC s online Sales Locator is available to help you evaluate the accuracy of the new assessment for your. Nassau County has paused property valuation updates due to continued instability of the real estate market.

You may file an online appeal for any type of property including commercial property and any type of claim including errors in your propertys tax class or exemptions. Please enter your login information below. PROPERTY TAX GRIEVANCE AUTHORIZATION.

All Live ARC Community Grievance Workshops. Last year for the 2019-20 tax roll the commission received 36000 appeals from homeowners who represented themselves. If you have selected a professional firm such as Maidenbaum to represent your interests you will be periodically notified of the status of your grievance.

How to File an Appeal Using the AROW System. If you have selected a professional firm such as Maidenbaum to represent your interests you will be periodically notified of the status of your grievance. Only the assessment on the current tentative assessment roll can be grieved - you cant grieve assessments from prior years.

Etsi töitä jotka liittyvät hakusanaan Nassau county tax grievance status tai palkkaa maailman suurimmalta makkinapaikalta jossa on yli 21 miljoonaa. If you want to lower your Monthly Mortgage Bill and save money this is one of the easiest ways. Nassau County residents should file a tax grievance each and every year.

Well perform a property tax assessment and advocate for your interests in your quest to lower your property taxes.

News Flash Nassau County Ny Civicengage

Tax Grievance Appeal Nassau County Apply Today

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

District 16 Arnold W Drucker Nassau County Ny Official Website

Tax Grievance Deadline 2023 Nassau Ny Heller Consultants

Nassau County Tax Grievance Property Tax Reduction Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

All The Nassau County Property Tax Exemptions You Should Know About

5 Myths Of The Nassau County Property Tax Grievance Process

Nc Property Tax Grievance E File Tutorial Youtube

Nassau County Property Tax Reduction Tax Grievance Long Island

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Make Sure That Nassau County S Data On Your Property Agrees With Reality

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Property Taxes In Nassau County Suffolk County

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

Nassau County Grievance Filing On Property Tax Property Tax Grievance Heller Consultants Tax Grievance